Understanding the Concept of Money

May 17, 2024 By Triston Martin

In the world of economics, money is like a building block for transactions. It helps people make exchanges with goods and services. Money can appear in many different ways, each having its unique features and jobs to do. This article takes an extensive look at money, what it means, its importance in history, various kinds possible as well as how they come into being through the creation process.

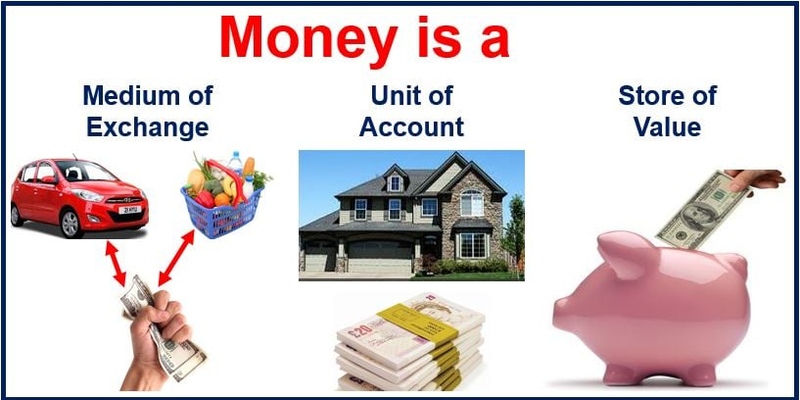

The Definition of Money

Monetary systems, being tools for exchange, offer a common unit of account that makes comparing values possible. This attribute allows people to assess the worth of various goods and services. Money also works as a storehouse for wealth over time. When we possess money, it means we have control over valuable resources or items at any given point in our lives which can be preserved into future periods with relative ease.

Also, money has an important role in deciding and guiding economic strategies and the functioning of financial markets. As a means of monetary policy, central banks make use of different methods to control the money supply that affects rates of interest as well as inflation levels. Moreover, digital currencies have expanded the scope of money itself by introducing fresh ways to exchange value that go beyond physical borders and conventional banking systems.

- Consideration: It's important to recognize that the definition of money can vary depending on cultural, historical, and economic contexts. Different societies may have distinct forms of money, including alternative currencies or barter systems, that reflect their unique socioeconomic dynamics.

- Caution: While money serves as a cornerstone of modern economies, excessive reliance on monetary instruments can lead to financial instability and economic imbalances. It's essential to maintain a balance between monetary expansion and price stability to safeguard against inflationary pressures and currency devaluation.

The Historical Evolution of Money

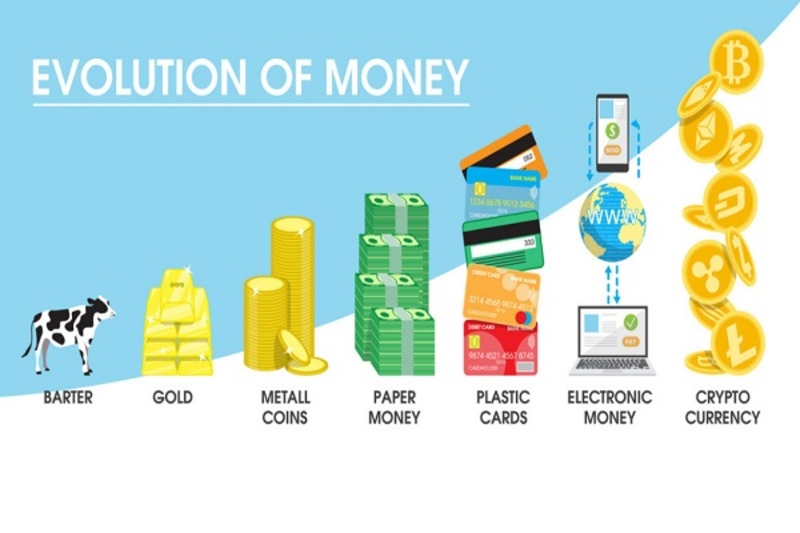

The journey of money goes hand-in-hand with the progress of human civilization, mirroring changes in society's needs and complications. From basic trade methods in ancient civilizations to complicated financial tools today, the idea behind money has experienced an astonishing shift. Commodity money like precious metals arose as a physical means for swapping goods, supported by its value and rarity.

When economies grew and trade networks spread, commodity money was not enough to support the increasing needs of transactions. The idea of representative money came about, which is a form backed by a central authority or some kind of commodity reserve. This made it easier for people to exchange value and trust in financial dealings, leading to more stable economies globally. In time, the shift towards fiat currencies that are supported by full faith and credit from governmental bodies transformed monetary systems worldwide. It allowed for an unmatched rise in economic growth as well as globalization at levels never seen before.

- Consideration: Throughout history, the scarcity and durability of certain commodities, such as gold and silver, have contributed to their widespread acceptance as forms of money. However, the reliance on finite resources poses challenges in meeting the expanding needs of modern economies, prompting the exploration of alternative monetary solutions.

- Fact: The earliest forms of money were often non-metallic, including shells, livestock, and grain, reflecting the intrinsic value assigned to these commodities by ancient societies.

Exploring the Types of Money

Money is not only paper or metal. It comes in many forms for different economic functions and preferences. Cash, which includes banknotes and coins, continues to be the physical representation of currency that we are familiar with. It supports daily transactions and provides liquidity in a way no other form can match up to. Digital currencies have appeared recently as fresh options to customary fiat money types. They use blockchain tech to give decentralized and safe ways for exchanging value.

Bitcoin, Ethereum, and other similar digital currencies have caught the interest of many people for their possible ability to shake up normal money systems. People could have more power over their own money and financial activities. Money in electronic form, like digital wallets or prepaid cards, is also becoming common because it offers easy and quick ways of paying in an increasingly digital world.

- Consideration: While digital currencies offer advantages in terms of accessibility and security, they also pose unique challenges, including regulatory concerns and potential risks associated with cyberattacks and market volatility.

- Fact: The concept of electronic money predates the rise of cryptocurrencies, with early forms of digital payment systems dating back to the late 20th century.

The Creation of Money

The process of making money is a complicated one that involves central banks, commercial banks, and the larger financial system. Central banks have the power to create currency and they manage it by regulating how much money there should be in circulation for meeting bigger economic goals like keeping prices steady or having sustainable growth of the economy. These control functions are performed through methods such as market operations which are open and reserve necessities, among others. In this way changes to the volume of money available impact interest rates as well as inflation rates among other factors.

Commercial banks, under the system of fractional reserve banking, have a big role in making money by enlarging credit. They take deposits and loan out some of it too. This way, more money is added to the economy because when people get loans from these banks they can spend that borrowed amount on goods or services, which stimulates economic activity and investment. However, making money in this manner also has its dangers. Excessive lending and leverage may worsen financial instability along with systemic vulnerabilities.

- Consideration: Fractional reserve banking allows banks to lend out more money than they hold in reserves, thereby magnifying the impact of their actions on the broader economy. However, this practice also exposes banks to liquidity and solvency risks, especially during periods of economic downturns or financial crises.

- Fact: The concept of fractional reserve banking dates back to ancient civilizations, where early forms of banking emerged to facilitate trade and commerce. However, the modern banking system underwent significant transformations during the Industrial Revolution, paving the way for the establishment of central banks and regulatory frameworks.

Challenges and Innovations in Money

Money, even though it is present everywhere, has to deal with many problems in a changing worldwide economy. Inflation is one of these issues and it happens when there's an ongoing rise in the general price level which reduces money's buying power over some time. This means that money no longer holds its value as much for saving wealth. On the other hand, deflation occurs when there is a decrease in prices and this can cause economic stagnation along with debt deflation risks to financial stability and employment.

Technological advancements have fueled innovations in the realm of money, revolutionizing the way transactions are conducted and managed. Blockchain technology, the underlying technology behind cryptocurrencies, offers decentralized and immutable solutions for value exchange, bypassing traditional intermediaries and enhancing security and transparency. Digital payment platforms, such as mobile wallets and contactless payment systems, have streamlined the process of financial transactions, promoting financial inclusion and accessibility.

- Consideration: While technological innovations offer immense potential in improving the efficiency and accessibility of money, they also raise concerns regarding privacy, cybersecurity, and regulatory compliance. Policymakers and industry stakeholders must strike a balance between innovation and risk mitigation to foster a robust and inclusive financial ecosystem.

- Fact: The concept of central bank digital currencies (CBDCs) has gained traction in recent years, with several countries exploring the possibility of issuing digital versions of their national currencies. CBDCs aim to combine the benefits of digital currencies with the stability and credibility of fiat currencies, potentially reshaping the future of money and monetary policy.

Conclusion

To sum up, money is like the blood that keeps modern economies alive. It helps with trading things and services, as well as providing a steady way to measure value. Knowing about money's complexities, from how it has changed over time to its various types and making methods, is crucial in handling the complicated global financial system we have now. With technology changes altering how money works around us, the development of currency keeps happening. This brings fresh chances and issues for those involved in economics all over the world.

Navigating Disaster: A Guide to Assistance Without Flood Insurance

Feb 03, 2024

A comprehensive guide providing practical solutions for homeowners without flood insurance to recover from flood damages and steps to prepare for future flooding events.

Understanding The Details Of The Hurricane Insurance Deductible

Oct 28, 2023

Not only do you keep your money in your home, but it's also where you feel the most comfortable. You have house insurance coverage since it's probably your most precious investment, and you want to protect it. However, even the best homeowner's insurance does not entirely protect against storm damage. If you live near the coast, choosing the right storm insurance policy requires understanding what your homeowner's insurance policy will and won't cover.

Reason of Trade Broken Trendlines

Feb 03, 2024

When technical traders want to gain a rapid notion of the trend or direction of an asset, one of the simplest methods to do so is to plot the trendlines of a security's price action onto a chart.

Legal Status of Airbnb in Major Cities

Jan 25, 2024

Airbnb is a popular choice among thrifty vacationers since it is a short-term rental business that allows property owners as well as renters to earn extra money by renting out their homes to other guests. On the other hand, it might be a difficult task for regulatory bodies all over the globe.

EquityZen Review 2024: Is it a Legitimate Company?

Mar 15, 2024

Get everything you need to know about investing in pre-IPO shares in this EquityZen Review 2024.

Complete Understanding of Joint Endorsement and Its Operational Mechanism

Jan 03, 2024

Joint endorsements are essential in shared finances. Click here to learn their operational mechanism, challenges, benefits, and disadvantages.

How Excess of Loss Reinsurance Operates in the Insurance Industry?

May 08, 2024

Explore the crucial role of Excess of Loss Reinsurance in managing catastrophic risks, its benefits, claims process, and future trends in the insurance industry.

Understanding Home Appraisals

Jan 13, 2024

Have you ever wondered why home appraisals are so important? Read on to find out how home appraisals can affect your ability to purchase a new property and get tips for getting the most out of yours.

Comparison Between Weakthfront and Vanguard

Nov 23, 2023

Learn what sets Wealthfront and Vanguard apart and discover which investment platform best fits your financial goals. Read more

Understanding the Concept of Money

May 17, 2024

Unveil the essence of money as well as its definition, historical evolution, various types, and the intriguing process of its creation.

401(a) vs. 401(k): What’s the Difference?

Feb 22, 2024

Educate yourself on the differences between 401(a) and 401(k) plans and determine which could benefit your retirement. Unlock financial insights today!

Top 10 European Tax Havens of 2022

Dec 08, 2023

Extending from Western Europe to Malta, countries such as Switzerland, Netherlands, Germany, and Luxembourg are among the top tax havens in Europe. They offer favorable tax environments for capital gains, income, and corporate taxes.